Posts

Unique legislation use if you utilize your vehicle 50% or smaller on your work otherwise company. For individuals who wear’t make use of the fundamental usage price, you happen to be in a position to subtract the genuine automobile expenditures. But not, while you are self-operating and employ your car or truck on your own organization, you could potentially deduct one part of the focus expenses you to means your online business utilization of the automobile. Such as, if you utilize your vehicle 60% to have organization, you could deduct sixty% of the interest to the Plan C (Setting 1040).

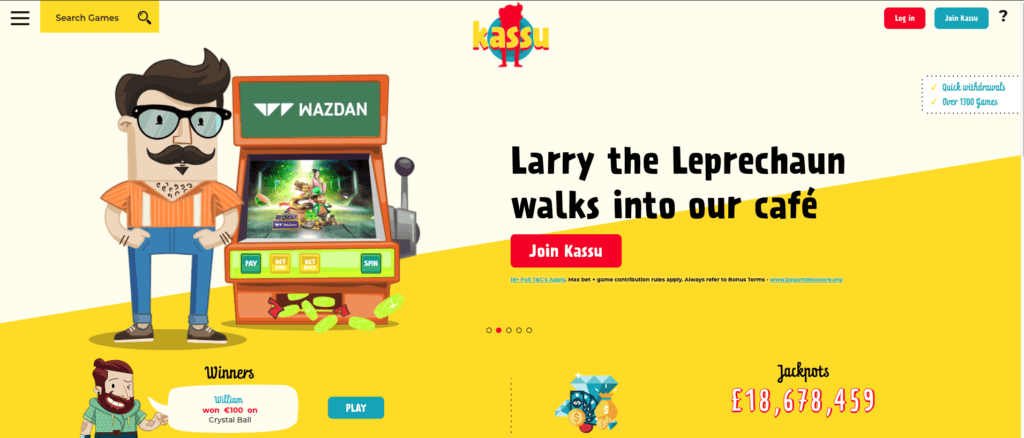

Regulated versus Unregulated Online gambling Web sites in the us

I am aware they which you never ever heared of your local casino and you may that’s why I’ll leave you more details regarding the local casino. Needless to say I am also revealing my personal sense from the gambling enterprise along with the $step 1 deposit extra. Individually I enjoy they whenever an internet gambling enterprise provides a slightly other incentive.

Print Your Statement

If the successful, this will earn overall settlement packages you to meet or exceed $1 million annually to your MDs. For example a base salary usually ranging from $350,one hundred thousand and you will $600,000, having incentives usually coordinating otherwise surpassing foot wages. Introduced inside the 2006, Rival Gaming are an excellent All of us-friendly application vendor you to definitely provides video game to help you at least 52 casinos. In the more 10 years, Competitor has continued to develop more than 200 online game inside eleven languages, so it’s one of the most common brands international.

The bucks type bookkeeping is actually explained inside chapter step 1 lower than Bookkeeping Tips. However, come across Revealing options for bucks method taxpayers, why not try here later on. Attention for the You.S. debt provided by one agency or instrumentality of the United states, such U.S. Treasury debts, cards, and you may ties, try nonexempt to have government taxation intentions. For many who found noncash gifts otherwise services in making places otherwise for starting an account within the a cost savings business, you might have to report the benefits because the interest.

- Have you any idea from an on-line casino who may have a zero put campaign you to definitely didn’t make my list?

- Your, your lady, and your 10-year-old son all stayed in the us for everybody away from 2024.

- You’ll find this short article at the GSA.gov/travel/plan-book/per-diem-cost.

- They’re able to help you ready yourself future tax statements, and you need them for individuals who file an amended come back otherwise is audited.

- If element of your trip is outside of the All of us, make use of the laws and regulations explained after within this part below Travelling Outside the usa regarding an element of the travel.

To do this, all of our gaming advantages regularly give advice to your a variety of subject areas surrounding casinos and you will bonuses. You’ll discover a profit-worth of added bonus credits (such £/$/€10) you should be able to bet on a variety of game, in addition to slots, dining table online game, keno and you will scrape notes. The pro content articles are made to elevates away from scholar to help you specialist in your experience in online casinos, local casino bonuses, T&Cs, words, game and you will all things in anywhere between.

Paysafecard

Your satisfy foundation (2) because you got backup bills. You also meet foundation (3) since you didn’t abandon your own flat within the Boston since your chief household, your leftover their neighborhood connectivity, and also you seem to gone back to inhabit your apartment. Fundamentally, your own taxation house is your normal place of business otherwise post from obligations, no matter where you keep up all your family members household. It provides the complete area otherwise general town where your organization or tasks are discovered. Your get off their critical and you will return to it afterwards a similar date.

You bought another car within the April 2024 to have $twenty-four,five-hundred and used it 60% for organization. Based on your online business use, the entire price of your vehicle you to qualifies to the point 179 deduction is $14,700 ($24,five hundred costs × 60% (0.60) team have fun with). But come across Limit to the complete point 179, special depreciation allotment, and you may depreciation deduction, discussed later on. You can elect to get well all the otherwise the main rates from a vehicle which is qualifying section 179 property, to a threshold, by subtracting it in you put the home in the service.

You are able to choose direct out of family processing condition while you are thought solitary since you live aside from your own companion and you can meet certain testing (informed me below Lead out of House, later). This can affect your even although you are not divorced otherwise legally split. For those who qualify in order to document since the lead of household, rather than because the partnered processing independently, your tax could be straight down, you happen to be in a position to claim the brand new EIC and you will certain other advantages, and your basic deduction would be high. Your mind from house processing condition enables you to buy the simple deduction even though your wife chooses to itemize deductions. For individuals who get a legal decree from annulment, and therefore retains you to no legitimate wedding ever before existed, you’re felt solitary even if you registered mutual output to have prior to years.

A QCD is generally a nontaxable shipping produced myself by the trustee of your own IRA so you can an organization permitted receive income tax allowable contributions. To learn more, in addition to ideas on how to contour the necessary lowest shipment annually and you will simple tips to figure their necessary shipment when you’re a recipient from an excellent decedent’s IRA, discover When Must you Withdraw Property? The new 10% additional taxation on the distributions created before you can many years 59½ cannot apply to these types of income tax-free withdrawals of your contributions. But not, the fresh shipping interesting or other money need to be advertised to the Mode 5329 and you can, unless of course the new distribution qualifies to have a different for the many years 59½ code, it might be susceptible to that it tax.